How to grow happy customers

The best way to measure whether (or not) a business’ customers are ‘happy’ is that they come back, spend more and hopefully spread the word to their friends, family and others. Assumptions could be made that if tangible measures such as units sold and customer retention are growing, customers are happy with the product or service, or happy enough.Yet, businesses and other customer focused entities have long realised that a commitment to building customer contentment is a medium to long term priority as improvement in the short term may not have an immediate impact. So, it is worthwhile to monitor what is going on in the minds of happy and not so happy customers, so the good bits can be leveraged and bad bits resolved.

Measuring customer satisfaction has evolved over the past 50 years, and is now an entrenched critical key performance indicator of boards. Short and larger surveys to online customer communities have become common in most notable businesses. However, is this actually making customers happier?

It seems hard to have a product or service experience without being asked for feedback. This might be an email or phone alert asking ‘how did we perform?’ to stores offering cute buttons at the store exit with happy and sad faces you can press to encapsulate your exuberance at paying for petrol or a pie with sauce. We are asked to rate our restaurant and hotel experiences, to taxi, uber, Airbnb, banks, the Apps we use and others seeking positive reviews. A level of feedback fatigue starts to grow, particularly when the feedback is perceived to have little if any impact on making anything better for the customer.

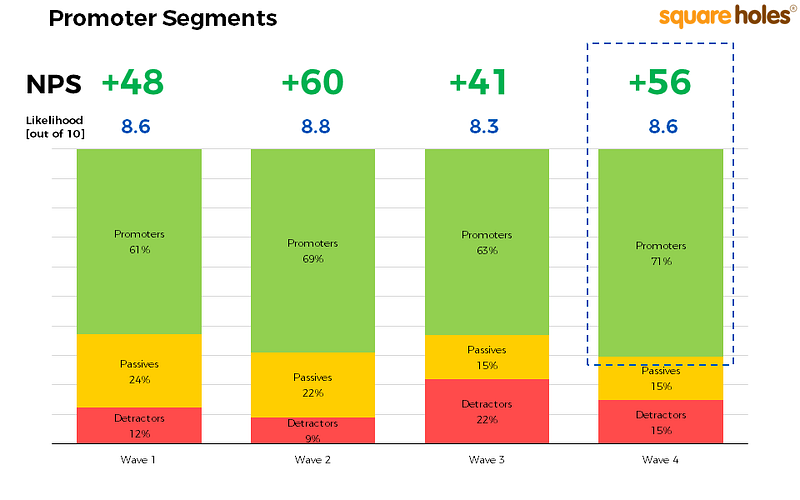

In recent years NPS or Net Promoter Score has become en vouge as attempts to measure if a business has more promoters, passives or detractors has become an almost mandatory management measure. Apparently around two-thirds of Fortune 1000 companies use the metric.

To measure NPS customers are asked to provide a rating from 0–10 as to ‘How likely is it that you would recommend our company/product/service to a friend or colleague?’ The resulting ratings are used to calculate a Net Promoter Score that can be as low as -100 (everyone is a ‘detractor’ providing a rating 0–6) to as high as +100 (everyone is a ‘promoter’ providing rating 9–10). To calculate the score is by subtracting the percentage of customers who are detractors from the percentage of customers who are promoters.

NPS potentially allows one company to benchmark against other businesses, and to build more promoters than detractors, and asking subsequent questions can be asked as to why the rating was provided, to offer some insight into why people are promoters or otherwise. However, the reality is that a customer giving a rating of 9 or 10 out of 10 is likely a poor estimator to customers actually promoting in the real world to friends, family and others.

The reality is that customers aren’t that simple, and it can be difficult to know if they are happy or even content, sharing positive or negative word-of-mouth or even if this actually matters to the revenue and profitability of a business. And, sometimes the happiest customers are actually the least profitable, and the customers who don’t need or care for ‘happy’ are the most valuable.

What makes it even harder, is that customers are more able to complain about poor product and service experiences, and for many, such whinging on Facebook, Twitter and other social media has become the 15 minutes of fame of people with an axe to grind at their bus running a few minutes late, or the barista not knowing what a half-soy-latte is, or just having a grumble that may or may not be justified.

“In the future, everyone will be world-famous for 15 minutes” Andy Warhol 1968

Even the best business has crazy customers that may be best ignored, but everyone has a potentially loud voice. The rantings of crazy grumpy customers are feared to spread like wildfire, yet positive word-of-mouth is seemingly like seeding and growing a rare and delicate flower. It takes much more than a good experience to generate a conversation worth sharing.

So, the question often comes back to ‘How do we generate more extremely happy than extremely unhappy customers?’ And, this is the complex bit of running a business. With the extremely unhappy potentially far more prevalent and loud than the somewhat shy extremely happy, or even passive customers, they may seem to be the voice of reason, the true customers, yet likely the silent majority are those a business should be most interested in.

Critically the 4 questions for a customer focused business are …

- What do we do well?

- What do we do not so well?

- What matters?

- And, what doesn’t matter?

And, from these questions come a mantra such as …

Consistently do the right things right.

The focus moves to what matters to customers and to do this consistently.

Simply waiting for customer feedback and listening to social media will not suffice. Most likely this will only capture the extremes of customers — the extremely happy and the extremely unhappy, and more of the latter, who may or may not be rational and representative of other customers.

Critical in growing a happy and profitable customer base is ever improving the precision in consistently doing the right things right; listening to customers in a robust way; and continuously improving on what matters most in encouraging customers to come back, spend more and actually share positive word-of-mouth with friends, family and others.

Market research plays an important role in this. As the independent, expert voice of the customer, professional researchers are able to deploy surveys and other feedback mechanisms such as qualitative approaches and online communities, to collect information to ensure confidentiality, privacy and a representative sample of customers, and more importantly to identify priorities fitting with the wider business strategy and targets.

Below are six thought pillars to monitoring and building happy customers …

1: Seek feedback from a wide cross-section of customers

The key role of a robust customer research program is to overcome the noise distraction from grumpy customers and ecstatic customer who may, but likely will not, represent the typical customer. The reality is that most customers, happy or otherwise, are too busy to provide feedback. It is therefore important to utilise research approaches to attract a wide cross-section of the community. This may include hybrid approaches such as online surveys, with telephone follow-up; and providing an incentive to encourage feedback (e.g. prize(s), charity contribution, access to unique product / service, engaged tribe of customers through ongoing relationship and trust building).

2: Encourage open and honest feedback without fear

Customers fearing that their feedback will result in consequences such as being made feel uncomfortable when needing to explain why they have negative views, will likely be more closed and less candid in their feedback. This can be a particular issue with more one-on-one or intimate relationships such as business to business or professional services. Promising confidentiality allows for open and honest feedback without fear of retribution. Protections from the Privacy Legislation place large potential fines in using and storing customer data inappropriately. Robust feedback needs to be collected to not allow such issues, and optimally conducted by experts with independence to avoid temptation and protect customers.

3: Monitoring at an overall level and key steps in the path to purchase.

Measuring overall satisfaction, NPS or other measures of customer contentment is useful from an overall key performance indicator perspective, yet also critical in micro aspects of the product or service, or along the path to purchase. This will allow for critical gaps and weaknesses to be identified. Typically measuring performance in differing areas is valuable in a closed manner (e.g. “how would you rate the performance in the following areas?”) as well as using more open questions (e.g. “what were the areas not performing well?”). However, only using open questions can just create a long list of problems to resolve, which can result in making no real change.

4: Define priorities to avoid improvement chaos.

Continuing on from the above point, the key role of monitoring customer satisfaction should be to identify improvement priorities. An area with lower satisfaction or performance may not be the highest priority, as it may or may not be important. For example, the branch staff at a bank may perform at a lower level than other aspects of customer service, but customers may not be too concerned with this, as they rarely go to a branch.

One way of setting priorities is to ask both performance and importance across a set of aspects of customer service or the path to purchase, this allows for the identification of aspects with lower performance and higher importance relative to other factors. What are the right things worth ensuring are doing consistently right? In the below visual the factors in the top right are the priority areas for this enterprise. Factors in the top left denote priorities for improvement.

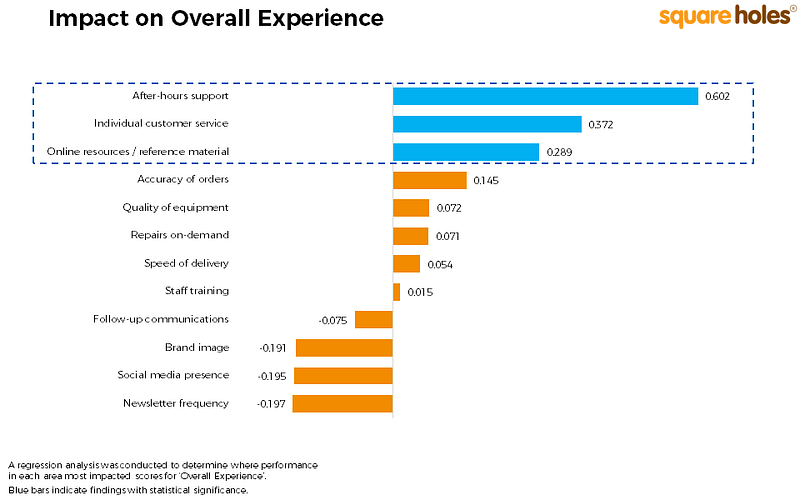

Another approach is using statistical analysis such as regression. This allows for a greater level of precision in defining priorities. Future to this, with increasing pressure to reduce the length of questionnaires and survey duration, yet balancing this with needing to collect a minimal level of necessary data to identify and drive change, approaches such as regression analysis are increasingly valuable to identify the critical drivers to satisfaction. Regression is also important in gaining an understanding of subconscious customer drivers.

While asking how important a list of factors are to customers will measure top of mind conscious views, e.g. speed of delivery may be rated as important etc, regression is valuable in identifying which factors have the strongest correlation with overall satisfaction, performance and/or NPS. For example, for customers who are more or less satisfied, what are the factors they rated higher or lower compared with other customers, e.g. based on the visual below, speed of delivery may be rated higher, but after-hours support, individual customer service and online resources have the biggest impact on overall satisfaction, and are therefore worth setting as priorities to consistently delivered, where other areas have a lesser impact.

Regression can also be used to analyse against measures such as revenue, size of business to identify other drivers to satisfaction, performance and NPS.

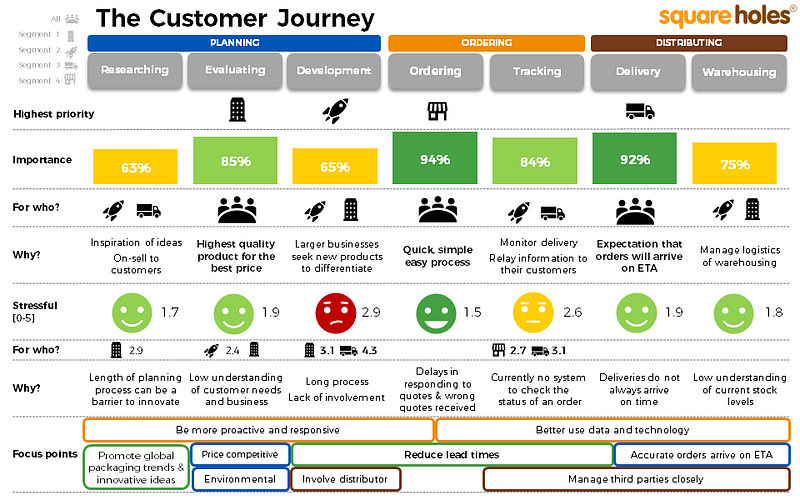

5: Map the customer journey and an innovation road map

Where are the critical stress points that should be a focus moving forward? Rather than businesses taking a scatter-gun strategy on evolution, such mapping can highlight where the team needs to be focused to build customer satisfaction, retention, positive word-of-mouth and opportunities to provide a unique offering to competitors. Rather than having a monkey mind to improvement in areas that potentially do not matter to customers or strategically, develop a heat map that can prioritise areas.

6: Don’t forget reality and the broader strategy

It is important to recognise that such monitoring of customer perceptions is valuable, yet needs to be balanced with a pragmatic analysis and interpretation. Customers do not always have the right answers, and typically they do not. Blindly following customer feedback is as dangerous as ignoring it. Rather than chasing a vanilla offering, it is critical that a business is strategic in finding an offering with a product—market fit and finding the right customers is likely an optimal priority for growth and improvement.

“The right customers are more likely to be satisfied with the experience, be promoters and share positive word-of-mouth (via social media and mouth to ear) to attract more of the right customers. Further to this, from our research, potential customers tend to largely ignore negative reviews of people unlike themselves (e.g. differing age, demographics etc) and rely more so on family, friends and others they trust ‘like them.’ In a solid business, the right customers stay, and the wrong customers go – which is just fine.” Customers are NOT equal