The elephant in the room wants to talk about MONEY

We may wish to view the solution to the world’s problems as love and the pursuit of one’s passion, but as the song says …

“MONEY makes the world go around. It makes the world go ‘round.” (More)

Even the most loving, self-sufficient home needs money to cover the needs and wants necessary to survive and prosper. There are many charities struggling to build the bridge between a very worthy cause and enticing donations. Governments fund social issues often less on merit than politics. A business will never survive if they don’t keep feeding the money monster.

As another well replicated song has said …

“Your love gives me such a thrill, but your love won’t pay my bills. I want MONEY.” (More)

It is nice to reflect from time to time that it is all ultimately about MONEY.

And, money is complex. It is far easier to spend than it is to earn.

There is a great deal of research illustrating that the prosperity of an individual largely comes back to their financial literacy from a young age. The ability to take appropriate financial risks, save and invest for the future. This is challenging as there are many cognitive biases and temptations that mean that people do the seemingly irrational financially.

Optimism bias infers that most assume that “everything will work out just fine” and this can lead to a tendency to underestimate negative events that might require emergency funds or savings. Or, it can also mean that people will take higher levels of financial risk than reasonable to gather a higher return as they over inflate the positive outcomes and underestimate the negative repercussions. Similarly, the overconfidence effect can mask competence particularly if the person has lower levels of literacy and mathematical ability (More). Many people want money, but lack the financial competency.

“Over the past decades, developed and emerging countries and economies have become increasingly concerned about the level of financial literacy of their citizens, particularly among young people. This initially stemmed from concern about the potential impact of shrinking public and private welfare systems, shifting demographics, including the ageing of the population in many countries, and the increased sophistication and expansion of financial services. Many young people face financial decisions and are consumers of financial services in this evolving context. As a result, financial literacy is now globally recognised as an essential life skill.” (PISA 2015: Financial literacy in Australia)

People generally have financial dreams—owning a home and/or beach house, travel, financial independence et cetera. From Square Holes’ financial behaviour research over the years, most people generally do not have any plan beyond the immediate and short-term and paying off the car finance and mortgage. They view the path to achieving financial goals as a bit about hard work, yet ultimately luck or winning the lotto and other gambling. Hence why gambling such as pokies, racing and sports betting via a handy App is becoming a major epidemic as the gamblers fallacy skews thinking towards believing that they can beat the odds.

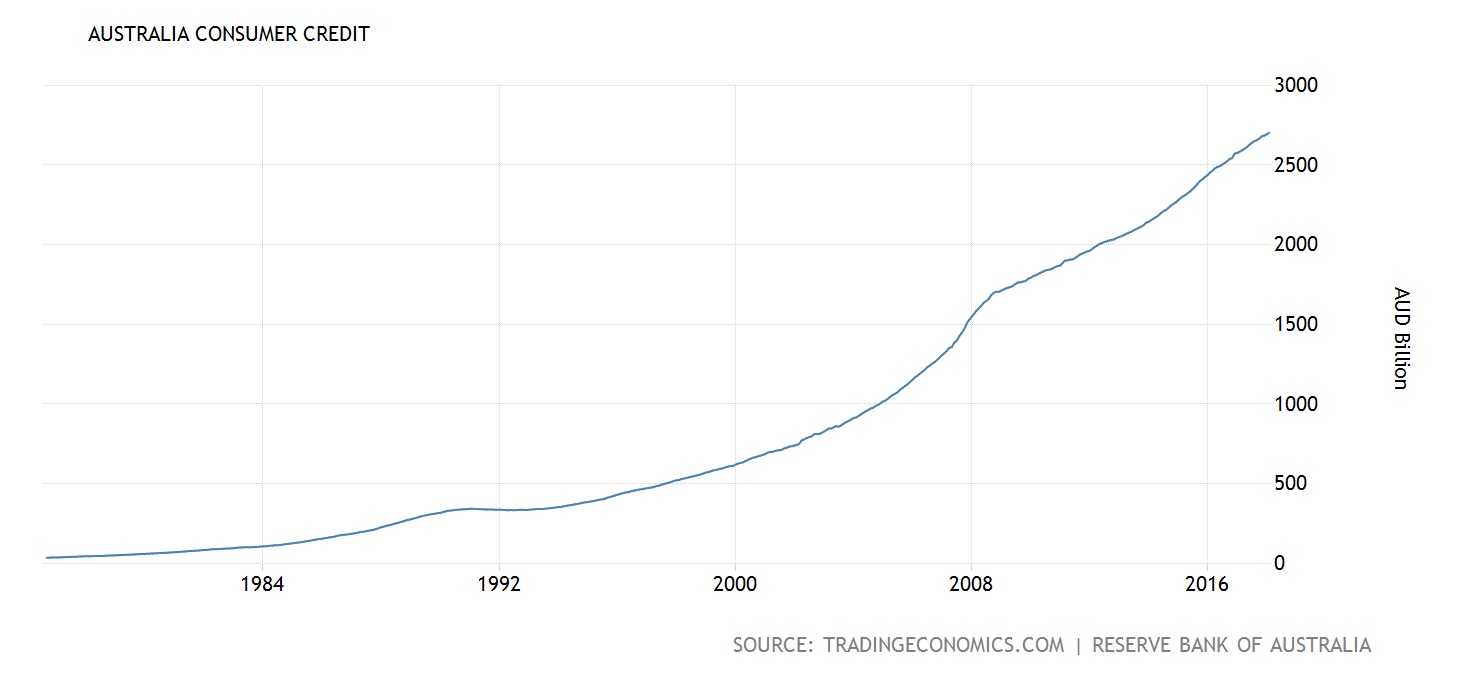

People find it inherently difficult to work towards and achieve financial goals. Thinking is often more so short term survival or indulgence, with little medium to long term planning. Particularly, when much of the innovation in banking and other financial services is in helping people to more easily spend at a flick of the wrist or easier, rather than innovation to save and achieving goals and aspirations.

How about a financial institution rewarded by its customers financial success and prosperity, not just fees and an interest rate? Services such as My Budget have filled a niche to counter the community’s lack of financial literacy. Some financial institutions are starting to offer tools to assist with budgeting and keeping track of spending which is positive, and there are many opportunities to do more in helping people to prosper.

Financial literacy is critical and an increasing focus for young and not so young. Programs such as ASIC’s MoneySmart Teaching program are growing in funding as savings are declining, credit card usage increasing and dreams of owning a home are believed to be getting further away for many.

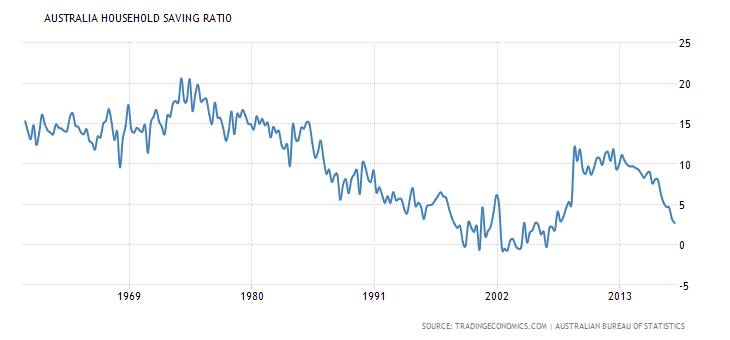

“Household Saving Rate in Australia decreased to 2.70 percent in the fourth quarter of 2017 from 3.20 percent in the third quarter of 2017. Personal Savings in Australia averaged 9.87 percent from 1959 until 2017, reaching an all time high of 20.60 percent in the third quarter of 1973 and a record low of -0.70 percent in the fourth quarter of 2002.” (More)

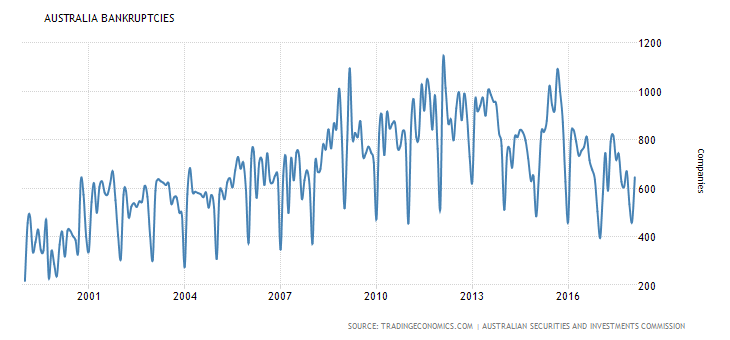

Teaching entrepreneurship in schools and to other young people is valuable, however, critical within this is financial literacy. Without financial literacy, entrepreneurs are likely to be very good at failing and bankruptcy.

There is research illustrating that young females perform above males, and a strong correlation with mathematical and reading literacy.

“On average, for Australia, around 29% of the financial literacy score reflected factors that were uniquely captured by the financial literacy assessment, while the remaining 71% of the financial literacy score reflected skills that were measured in the mathematical literacy and/or reading literacy assessments.” (More)

THE WORLD’S BEST IDEAS will never get far without money. Love and passion to change the world or a more selfish entrepreneurial mind will not gain reality without money. Survival is very hard in business. The monster needs to be fed constantly with money, and often lots of it to even survive. To scale typically needs even more money, and at times the profit and loss may be ringing alarm bells that the business is failing. It takes money and resilience to conquer.

The financial side of running a business is certainly the most complex. Generating sufficient revenue and/or positive cashflow to ensure that the business is able to pay staff, suppliers, overheads, tax and other costs and that it remains solvent and passes the annual solvency statement is vital. A good product and service is likely not enough to ensure that sufficient money is generated so a business survives and hopefully prospers.

It is all but impossible for a business to innovate, grow, pivot, be agile or even survive without money. Many businesses, particularly sole operators, may be able to, or need to, run on very tight budgets and margins, but this can just delay the inevitable demise of such businesses, and is why business failure rates are so high. Many people may dream and truly believe they will make excellent entrepreneurs, but typically this is not the case. It’s bloody hard, and the money side is the biggest legal and personal risk and common failure.

Ensuring that the business has a strong product-market fit (degree to which a product or services satisfies strong market demand) is important. Is there a sufficient demand to sell the product or service at the price required to make a viable gross margin that covers the many costs of running a business?

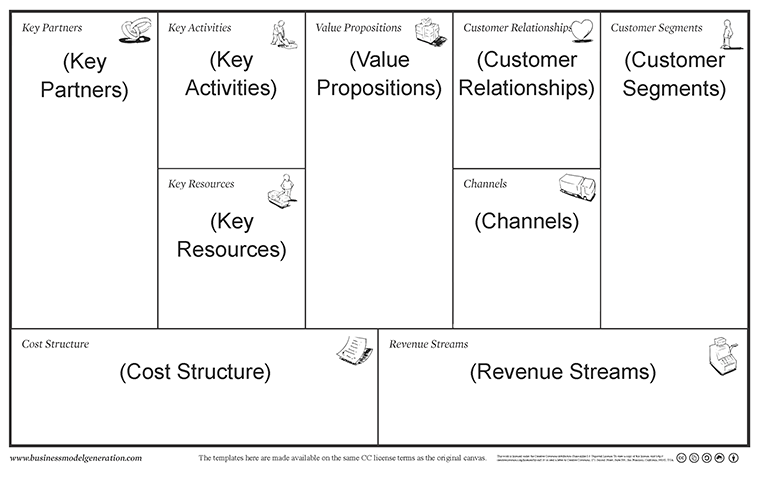

A commercially minded business model is also important to map critical aspects of the revenue steams, cost structure, channels et cetera, yet when reality hits the thinking is likely to change, and agility and problem solving comes to the fore. Having a team with high levels of competence and shared values is also vital, yet unless this all helps drive profitability and other financial outcomes the love will likely soon start to fade.

A budget with carefully set and monitored income and cost projections is also critical, but even the best planned targets can fall short if the market slows or the unforeseen arises. The gambler’s fallacy, overconfidence effect and optimism bias are likely even more present in the entrepreneurial community than general population.

That willingness to take a different path and create an enterprise requires innate self-confidence and willingness to make a change and take on high levels of risk. Being strategically prepared for the inevitable unexpected cashflow slowdown is important in any business.

Having a financial buffer in the event of cashflow declining is key. This may be from bootstrapping with own finance or borrowings, gaining smaller investors or larger investors. To scale often requires funds to be reinvested, or to run a business at break-even or even a loss in the short-term, or even into the medium-term in order to scale revenue, users, customers et cetera.

This may be a hard psychological and financial hurdle to overcome personally and for family, partners and investors involved. Traditional banks typically do not like investing in loss or break even businesses without a solid case, and private equity and other large investors generally have expectations of growth, revenue and other financial targets being hit, ultimately increasing the value of the investment. Expectations likely grow monumentally as the level of private investment grows. The entrepreneurial dream of being in control of their own destiny, can fade with the expectations of critical stakeholders involved and new perspectives and needs. This can be difficult when the future is unknown and change is inevitable and ever unexpected.

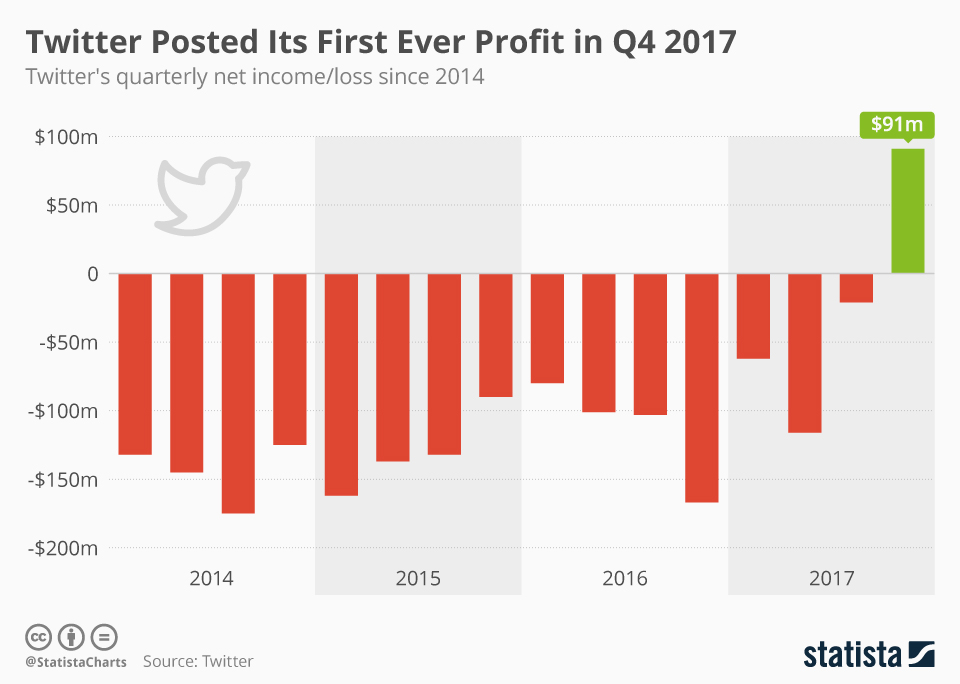

It took Facebook five years to become profitable, requiring a large amount of investor dollars to get there. It took Twitter eight years, losing $100 Million US per annum for much of its life since launching in 2009. Tesla continues to make large losses (-$2 Billion US 2017). Capital markets and investors are how such businesses survive and grow.

Money keeps business alive.

Money can create freedom if managed well or be the instigator of stress, bankruptcy and wider consequences if not. Rising levels of mental health issues amongst entrepreneurs is often attributed back to money pressures. Thankfully in recent years this has become a more open discussion, and support is increasing in this area. The ability to be able to manage money is critical, as is convincing funding providers and other key stakeholders that the business is heading in the right direction financially and strategically.

Money can create financial freedom. I recall hearing Mark Lollback the now CEO GroupM Australia and New Zealand presenting a few years ago at a conference when he was the CMO of ANZ Bank, discussing that his focus early in his career was to grow his personal financial reserves. This was to allow him the freedom to not need to stay in a job he hated or was counter to his values. He stayed at ANZ for just over a year.

Elon Musk was ever the financially astute entrepreneur with many business successes, and likely failures. From this he was able to invest $12 Million US of his own money into X.com, which merged with PayPal in 2000, after selling to eBay for $1.5 Billion US, Musk netted $180 Million US post tax (More). He also cemented himself as an entrepreneurial visionary leader worth investing in, even for seemingly risky, whimsical and loss making ventures that may or may not ever turn to profit.

We often hear of the successful business person who only takes home a relatively small annual wage. Chairman and CEO of Berkshire Hathaway Warren Buffet had a recorded salary of $100,000 in 2017, yet this is likely of limited hardship at home with a net worth of $88 Billion US. (More) It is much harder for a low scale entrepreneur to ‘underpay’ themselves for more than a short period, particularly if all their available funds are locked into the business, and they still have living costs to sustain for a relatively normal life (particularly when you add the financial responsibilities of being a ‘grown up’ – rent, car, groceries and other bills, family, kids, mortgage et cetera).

As businesses grow, the need for financial competence also grows. It always amuses me when social and traditional media proclaims a business’ VICTORY at raising $1 Million, $5 Million, $25 Million or more or less. This is typically just the start with escalating financial stakes, pressure and complexity. It can be an entrepreneur’s best of worst decision as a business’ financial structure changes taking on investors, difficult investors, losing control, uncomfortable decisions or other consequences.

Boards place financial governance responsibilities on all directors, not just the treasurer, to ensure solvency, and meeting serious legal requirements. Strong internal and external financial advisors and partners are critical for successful entrepreneurs (Square Holes has gained great value from having the same internal and external accounting, banking and legal relationships for more than a decade—thanks Ros, Paul, Justin et cetera), yet ultimately the financial responsibility is with individual directors.

The answer is likely somewhere between “all you need is love” and “money, that’s what I want.” Love and passion does make it easier to deal with the challenges of life and business, yet being financially savvy is a vital counterbalance to this. Not necessarily rich, but highly financially literate.

Our own research and experience illustrates huge opportunities for financial institutions, government and others to innovate to better help the general population and entrepreneurs to have the tools and financial literacy to prosper.

Money should not be feared, but it needs to be respected. Do not ignore this elephant in the room.

I will leave the final immortal words to Abba …

“I work all night, I work all day, to pay the bills I have to pay. Ain’t it sad? And still there never seems to be a single penny left for me. That’s too bad. In my dreams I have a plan. … Money, money, money. Must be funny. In the rich man’s world. Money, money, money. Always sunny. In the rich man’s world. Aha-ahaaa … All the things I could do. If I had a little money. It’s a rich man’s world.”

More …