Buying local or global?

As local communities exit the emotional strain of COVID-19, the conversation around the importance of supporting local businesses grows. The world-wide economic stability has placed strain on our local businesses. Yet, is the reality most are just supporting the global marketing behemoths? How can local brands compete?

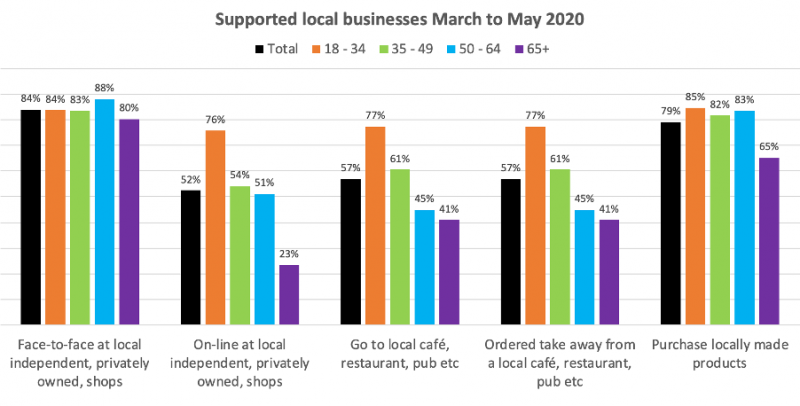

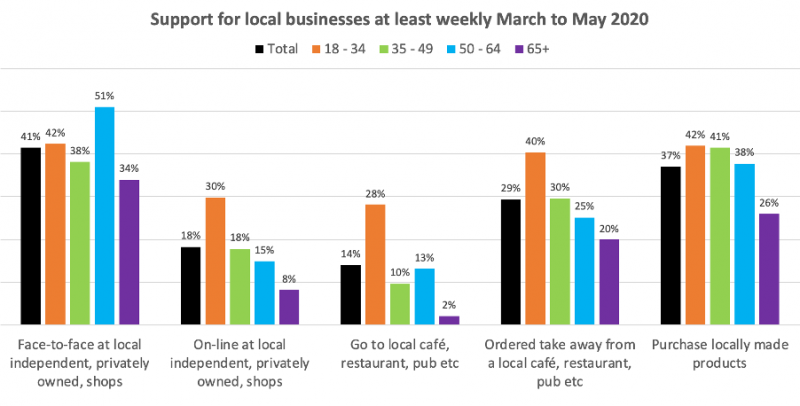

According to Square Holes’ monthly mind and mood survey with a representative survey of 400 South Australians aged 18 plus, the vast majority have supported local businesses over the past few months. More than eight in ten South Australians visited local independently owned shops, with this level consistent across age-groups, and across gender and regional and metropolitan areas.

Notable differences emerge for on-line shopping at local independents, going to cafes, restaurants and ordering take-away, with more than three-quarters of 18 to 34 year old supporting businesses, and declining levels of support in older age groups. South Australians aged 65 or more indicated lower levels of support for local businesses.

The vast majority supported local products and businesses over the past few months, with 37% claiming to buy local products at least weekly and a similar proportion shopping face-to-face at local stores. A larger proportion of younger South Australians, aged 18 to 34, supported local independently owned shops online at least weekly, and displayed similarly strong support for local cafes and restaurants in the especially challenging months.

There is a general understanding and regard for the products and services produced in South Australia. As an example, when asked which regions best match different food and beverage products, Adelaide Hills emerged as our gourmet leader, followed by Adelaide and the Barossa.

Food and beverage strongest product associations with regions (in rank order) …

| 1: Adelaide Hills Wine (53%) Jams & sauces (53%) Chocolate & sweets (50%) Fresh fruit & veg (50%) Gin & other spirits (28%) | 2: Adelaide Restaurants, bars, cafes (74%) Beer (50%) Bakery (45%) Chocolates & sweets (41%) Gin & other spirits (22%) | 3: Barossa Wine (77%) Jams & sauces (35%) Restaurants, bars, cafes (32%) Bakery (28%) Cheese & dairy (25%) |

| 4: Fleurieu Peninsula Cheese & dairy (39%) Wine (38%) Bakery (29%) Olives & olive oil (27%) | 5: Clare Valley Wine (49%) Cheese & dairy (20%) Restaurants, bars, cafes (20%) Bakery (20%) | 6: Kangaroo Island Native Australian (32%) Seafood (31%) Cheese & dairy (22%) Organic farming (17%) |

| 7: Riverland Fresh fruit & veg (38%) Restaurants, bars, cafes (16%) | 8: Eyre Peninsula Grain, cereals, flour (34%) Seafood (33%) | 9: Limestone Coast Wine (32%) Seafood (17%) |

| 10: Yorke Peninsula Grain, cereals, flour (32%) Seafood (26%) | 11: Murray River, Lakes, Coorong Seafood (23%) Native Australian (19%) | 12: Flinders Rangers & Outback Native Australian (38%) Red Meat (15%) |

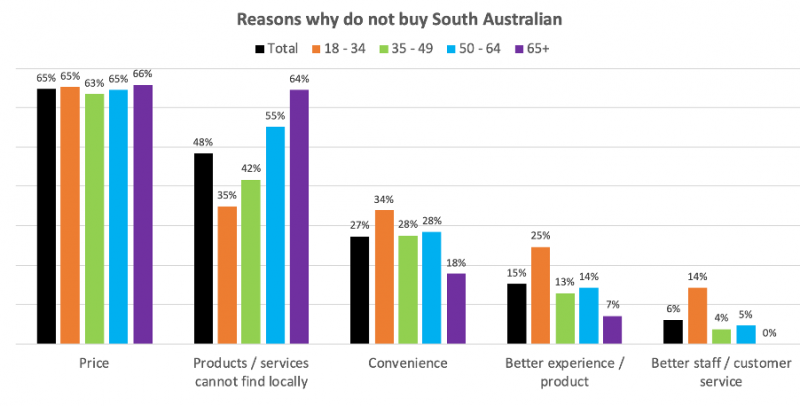

Even so, there is lack a knowledge gap, with on average one fifth of South Australians unable to match a region with the 15 food and beverage categories. Bigger gaps in understanding were found for gin and other spirits (33% did not know), organic farming (34% did not know) and red meat (33% did not know). The inability to find suitable local products and services was noted as a prominent reason for not buying local, second only to price.

Price was noted as the main reason for not supporting local, with this consistent across age groups, gender and regional and metropolitan areas of South Australia. While there was a small willingness to pay more for local products, Square Holes’ research illustrates a relatively tight willingness to pay more. Local brands are expected to be price competitive, as households are finding times financially hard and need to save money, however, they can.

As noted by a research participant …

“So many people that I talk to are saying, ‘We need to buy Australian products.’ And I agree. I 100% agree. But it all comes down to price.”

Square Holes research participant

And another …

“It doesn’t matter how much you want to support that business, financially that’s where it becomes a pivot point. If it was a $1 or $2 cost, I wear that cost to buy local. But $8 on something that I have to have all the time, it gets too much. So I think most people, unless [they’ve] got a fair amount of discretionary, then it doesn’t matter. I think for some people there’s a price point and they just can’t sustain that.”

SQUARE HOLES RESEARCH PARTICIPANT

There is a general understanding amongst South Australians of the importance of buying local, and support for campaigns such as Australia Made and I Choose SA, yet many consider that we are more so part of a global marketplace, and that it is vital businesses are competitive locally, and think globally in order to grow.

“I take a bigger view. You know, we want to sell our Australian produce all over the world and we’re on the soapbox all the time about buying Australian. I think it’s a two-way street. I think we have to buy overseas products as well as exporting our products overseas. Otherwise our economy will go down the tube. So I just buy on price and I think it’s a bigger view of the world than just buy Australian.”

SQUARE HOLES RESEARCH PARTICIPANT

Square Holes is currently finalising research in relation to what Australians love to do, which also explores brands people love, like a lot or are passionate, first explored in 2010 and the 2020 update to be released in July. The research involved a representative survey with 2,000 people across Australia and 300 in South Australia, as well as focus group and other research.

Responses in South Australia were similar to those across Australia, with the top five brands named spontaneously in SA being large market dominant brands …

- Apple

- Cadbury

- Adidas

- Nike

- Samsung

The only local brand in the top 10 from the South Australia sample was Coopers, a South Australian icon with a long-established strategic priority of brand building locally and beyond. While Square Holes’ research over recent months indicates South Australians are proud and passionate about many of our local brands, and respect the quality of the products and service, there is a sense that our local brands are often more niche, rather than having broad market appeal.

While market domination may not be the strategic goal of many local businesses, Square Holes’ market research illustrates that growth generally comes from being well known and accessible locally and beyond. The research participants noted that even with the best intentions to support local, the brands they actually support tend to be large global marketing behemoths, who have made themselves highly visible and easy to buy a trusted quality product or service.

There is a desire for our local brands to go global, and many of South Australia’s iconic brands were noted as having success interstate and overseas. Haigh’s strong network of stores across Australia, and growing online sales. Off-road tech company Redarc sells through a network across Australia, via its own online presence and growth in Europe, North America, Middle East, South Korea and the United Kingdom. South Australian health and fitness tech juggernaut Sweat likely less loved in South Australia than it is globally, hence the strong revenue growth and following across the world. San Remo developing a strong brand reputation across Australia and selling pasta to the Italians and around 35 other countries.

As will be explored next week, supporting local is important, yet only one pillar to building a vibrant economy to match our world-class lifestyle. South Australia playing an increasing role in the global economy will be expanded on next week.

…

For more information on Square Holes’ South Australia Mind and Mood research, published in the InDaily Business Insights each Monday, visit squareholes.com/samindandmood/

To be kept informed about the release of our upcoming consumer research including our ‘Make Love Not War’ research exploring what Australians love to do, which also explores brands people love, like a lot or are passionate, first explored in 2010 and the 2020 update to be released in July.

Or, contact Square Holes to discuss our 15+ years working with brands and other B2C and B2B enterprises, and how we may be able to work with your organisation.